ShareSoc

INVESTOR ACADEMY

New Investors Start Here…

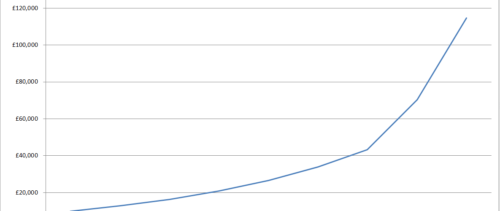

Congratulations on having reached this page which, we hope, will help you to embark on a successful investing journey! The journey may appear daunting at first, but pursuing it one step at a time can be both satisfying, offering constant opportunities to learn, and financially rewarding.

This part of the ShareSoc Investor Academy is sub-divided into a number of chapters. We recommend starting with our Investing Basics videos which will give you the confidence and skills required to make informed decisions when investing your money.

WONDERING HOW TO START?

Head to ShareSoc Investing Basics, covering everything from when and how to invest, to discovering new investment opportunities.

Not yet a member? Join FREE as an associate to access a variety of useful information. Or join as a full member for additional benefits including discounts on various investor services and access to exclusive online resources. See a comparison of membership benefits.

Types of investment

Many types of investment are available, which are summarised here, though ShareSoc focuses primarily on direct stock market investment.

Investment dos and don’ts

What you should do and what you shouldn’t, distilling the lessons of experience.

Investment Strategies

There is no one method for investing that works for all investors. This chapter outlines some of the main tried & tested ones.

Choosing a broker or “platform”

In order to buy or sell shares you need an account with a stockbroker (some broking services describe themselves as “platforms”). This chapter explains the types of service and accounts that are available, and how to find one that meets your needs.