This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

This article reflects the opinions of its author and not necessarily those of ShareSoc.

If you are a technology investor or simply tech-curious, you have likely heard of Nvidia. The US giant has become synonymous with Artificial Intelligence (AI) innovation, but there is another key player worth knowing: ASML, the Dutch company quietly revolutionising the technology landscape.

Who is ASML?

ASML Holding N.V. is a Dutch company founded in 1984. It is headquartered in Veldhoven, Netherlands, and is publicly traded on the Euronext Amsterdam stock exchange. It’s ADRs are also traded on the NASDAQ exchange. It is also one of the most important technology companies in the world today.

ASML is a leading provider of photolithography systems that play a crucial role in the optical etching of circuit patterns onto silicon wafers. The company specialises in deep ultraviolet (DUV) lithography systems, which are essential for manufacturing older semiconductor chips, and is the only supplier of extreme ultraviolet (EUV) systems, necessary for producing the most advanced, compact, and high-performance chips in the industry. These are the lithography machines, that the big fabricators like Taiwan Semiconductor (TSMC) and Samsung Foundries use to etch CPU designs down to such a small size, such as the latest generation 2nm chips. Only 3 companies in the world can produce CPU chips of 5nm and smaller at scale (TSMC, Samsung & Intel) and ASML is critical to that.

A single EUV system is approximately $200 million, and its transportation is complex, requiring multiple planes to ship the product. Major semiconductor foundries, including TSMC, Samsung, and Intel, rely on these advanced machines for their high-end chip production. ASML’s latest innovation, the “high-NA” EUV systems, designed for creating even finer chip traces, comes with a price tag of around $400 million.

ASML had an unexpectedly poor 3rd Quarter

ASML recently released its 3rd quarter results, which shocked investors causing a massive 16% drop in the value of its shares, giving up all its gains for the year. Even though its results beat expectations with revenue of €7.5 billion, compared to the €7.2 billion forecast, its order intake was much lower than forecast at €2.6 billion rather than the €5 billion expected.

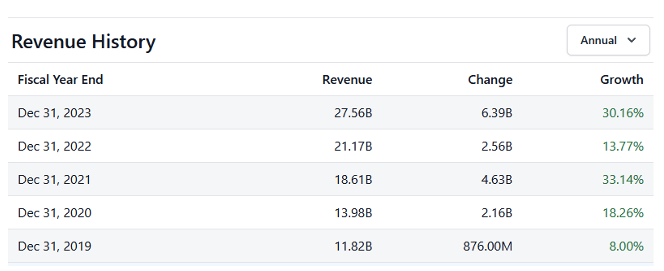

It also revised down its 2025 revenue forecasts to €30 – €35 billion from earlier projections of €30 – €40 billion, which would be the slowest growth rate in 9 years, raising fears that ASML’s growth rate had peaked. This is compared to its previous years’ rapid growth rate seen in the table below, driven by huge demand for 5G smartphones and PCs during the pandemic, as well as huge demand for new AI chips.

This also highlights an important aspect of ASML’s business model. It operates on a different cycle compared to semiconductor companies such as TSMC, which has surging sales at present. ASML’s machines are typically ordered several years ahead of the demand projections made by chip manufacturers. As a result, the fluctuations in ASML’s business are not synchronized with those of semiconductor fab companies like TSMC and Samsung.

Nevertheless, it is important to remember that the company currently still has an order backlog exceeding €36 billion, indicating a strong and sustained demand for its equipment.

Source – stockanalysis.com

Source – stockanalysis.com

Why did ASML have a bad quarter compared to other AI chip companies?

As stated earlier, there are only 3 companies in the world able to make 5nm (or smaller) CPUs at scale, TSMC, Samsung and Intel. Both Intel and Samsung are having problems developing their latest chips with an economic yield, and it is clear that this is reducing their purchases of ASML equipment. TSMC, although having incredible sales of its most advanced chips, is on a cost efficiency drive and has reportedly adjusted its equipment to extend their lifespan and make them more efficient, which may be reducing the company’s requirements for more ASML equipment and services.

Geopolitical Tensions

ASML has also been hit by a wave of geopolitical concerns. The US has worked with allies (including The Netherlands) to prevent China from building the most advanced chips, especially AI chips, which it fears can be used against themselves and the west. ASML, as one of the most important parts of advanced chip manufacture, has been included in this strategy, cutting off the large Chinese market to its most advanced lithography machines. ASML has reported that it does not expect these restrictions to either weaken or be removed. This is a big blow to ASML as sales to China made up 26% of its net sales in 2023.

Is ASML a good buy now?

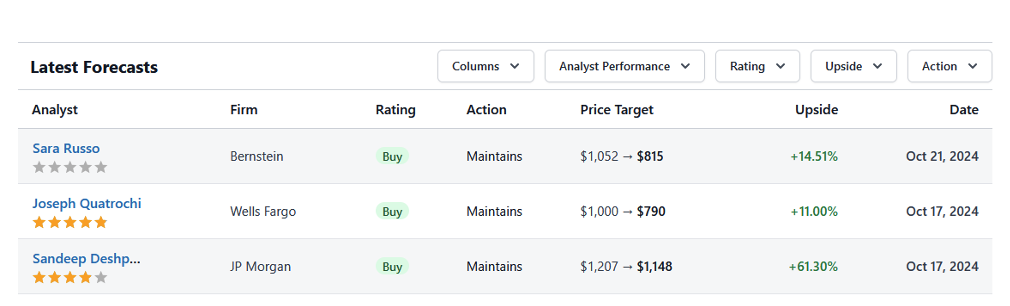

Source – stockanalysis.com

Source – stockanalysis.com

Even though I am not a fan of using analyst price targets to judge whether to buy a stock since they can be wildly inaccurate, and you never know if there is some type of ulterior motive at work, they can sometimes be useful when used with other evidence.

If we look at ASML’s new price target after it released its poor results, we can see that Bernstein, Wells Fargo and JP Morgan analysts all reduced their prices targets, but still maintained a “Buy” rating on ASML. This shows that they all feel that ASML was going through a rough patch at present but that they had confidence in the future performance of the company and understood that it was an important player in the semiconductor industry. This matches my own, personal opinion.

Source – Google Finance

ASML stock is currently valued at $712 per share (28/10/2024), which is considered reasonable at roughly 27 times forward earnings for one of the most important technology companies on the planet. However, I believe it may face challenges until it can improve its bookings growth.

Final Thoughts

For potential investors, key considerations include:

● A decline due to postponed orders from major customers

● A cooling demand in the lithography market

● Stricter trade restrictions impacting sales in China

While ASML may face some near-term challenges, it remains a critical player with an extremely promising future.

For technology-focused investors, ASML is definitely a company to watch very closely going forward.

Ram Sachdev, Director, ShareSoc

DISCLOSURE: The author holds shares in ASML Holding NV ADR

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.