This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

Sparkling Product, Sour Investment

Gusbourne PLC (GUS), an AIM-listed producer of English sparkling wine, is a case study in how minority shareholders in small-cap companies can be severely disadvantaged.

While the product itself may garner acclaim, the company’s recent trajectory has left a bitter taste for many individual investors.

Lord Ashcroft, Gusbourne’s majority shareholder and primary debt holder, is moving to take the company private, leaving smaller shareholders with severely limited and unpalatable options.

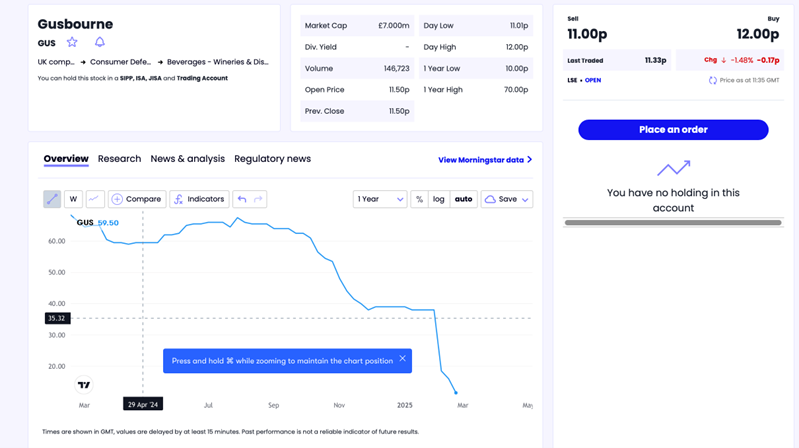

Gusbourne Share Price Performance

A Precipitous Decline in Value

The timeline of events, primarily sourced from LSE RNS announcements, paints a stark picture:

- 3 July 2023: Gusbourne announces the result of its AGM, at which shareholders have approved resolutions allowing the refinancing of existing loan facilities, with Lord Ashcroft potentially becoming the sole debt provider5.

- Early January 2024: Gusbourne shares trade at around 70p.

- 19 January 2024: Gusbourne announces the refinancing of existing loan facilities, with Lord Ashcroft becoming the sole provider of debt7.

- 22 July 2024: An RNS announces the commencement of an offer period. Lord Ashcroft offers to sell his interest in 40,628,009 shares, representing 66.76% of the issued share capital of Gusbourne6.

- 30 September 2024: Gusbourne releases its half-year report, presenting a positive outlook despite ongoing losses8.

- 8 October 2024: Gusbourne announces an extension to the repayment date of its debt facilities (held by entities controlled by Lord Ashcroft) via an additional £1m bond issuance9.

- 30 January 2025: Gusbourne releases a Trading Statement10.

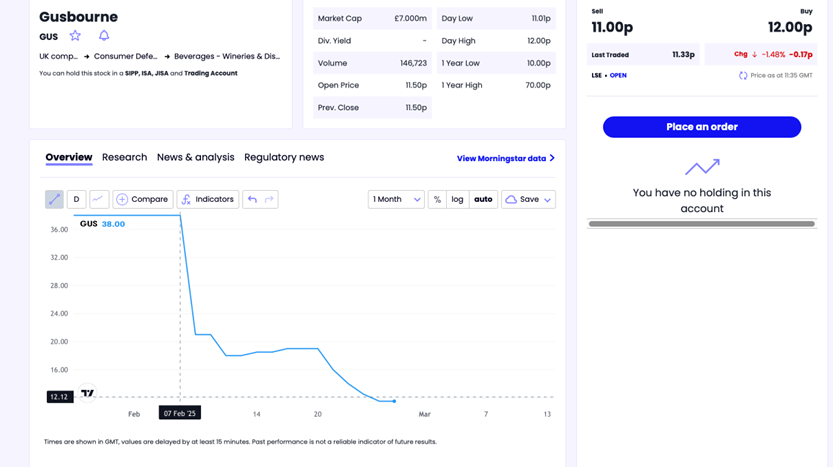

- Late January 2025: The share price falls to around 38p. This drop, following the trading statement and preceding the formal announcement of the delisting intention, suggests market awareness of internal issues.

- 6 February 2025: Gusbourne announces that it has received a letter from Belize Finance Limited (controlled by Lord Ashcroft) requisitioning a general meeting to consider delisting from AIM1. The company also announces the end of the offer period. The Board states its belief that delisting is in the best interests of the company and shareholders.

- 19 February 2025: Gusbourne releases a further RNS, providing the Notice of General Meeting, and outlining the reasons for the proposed delisting, including costs, regulatory burden, lack of liquidity, market volatility, and strategic flexibility2. It also details proposed board changes and the intention to implement a matched bargain trading facility via JP Jenkins.

- 7th March 2025: Date of the General Meeting to vote on the cancellation of trading.

- 18th March 2025: Expected last date and time for trading in Ordinary Shares on AIM.

- 19th March 2025: Proposed date for cancellation of trading of Gusbourne shares on AIM and commencement of the matched bargain trading facility.

- Current Situation (February 27, 2025): The share price stands at a mere 11.50p. Market capitalization is now roughly £7 million, while enterprise value (debt plus equity) is around £27 million.

Holders are faced with two unappealing choices: sell now at a deeply depressed price (effectively as forced sellers) or hold illiquid shares in a private company with no foreseeable dividends and no ready market to trade their shares (although the JP Jenkins facility is mentioned, its effectiveness is uncertain).

The Issues

This situation highlights several critical problems facing small shareholders in the UK, particularly in the context of AIM-listed companies:

- Vulnerability to Majority Shareholder Actions: Lord Ashcroft’s control, both as majority shareholder and sole debt holder, gives him immense power to dictate the company’s future, regardless of the interests of minority shareholders. The sequence of events – the AGM resolution, the offer period, the refinancing making Ashcroft the sole lender, the bond extension, and finally the delisting proposal – demonstrates a clear pattern of increasing control.

- Lack of Liquidity for Small-Cap Stocks: The illiquidity of AIM, particularly for smaller companies, exacerbates the problem. When a major shareholder moves to delist, there’s often no market liquidity for smaller investors to exit at a fair price.

- Directors’ Duty to All Shareholders: The Gusbourne directors appear to have failed to adequately protect the interests of minority shareholders. Allowing Lord Ashcroft to become the sole debt provider, and then supporting the delisting proposal, raises questions about whether the board acted in the best interests of all shareholders, not just the majority holder. The stated reasons for delisting (cost savings, regulatory burden) seem insufficient justification for the significant harm to minority investors.

- Possible Information Asymmetry: The share price decline in late 2024, after the 30 Sept 2024 interims statement and the 8 Oct 2024 RNS but before the 30 Jan 2025 trading statement and the 6 Feb 2025 delisting announcement, raises the question of potential information leakage.

- Valuation and the ‘Story Stock’ Risk: Gusbourne, despite never having turned a profit, achieved a high valuation based on future growth prospects and the “fizz” around English sparkling wine. The Interim Statement of 30 September 2024, with its seemingly optimistic outlook, appears questionable in retrospect. This story stock dynamic, fuelled by positive PR and comparisons to the booming French champagne house acquisitions in the UK, arguably masked the underlying financial risks.

- High Debt Levels: The Company has had very high borrowings compared to its equity, making it vulnerable.

The Need for Reform

This situation is not unique to Gusbourne; it’s a symptom of broader systemic weaknesses.

- Mandatory Offer at Pre-Announcement Price:When a company proposes to delist from a public market, the acquirer(s)/company (or, as preferred, the controlling shareholders) should be required to offer to buy out dissenting minority shareholders at the undisturbed share price (determined using a look-back formula).

- Enhanced “Fair Value” Protection:Building on existing squeeze-out provisions (which typically require 90% ownership), a mechanism should be introduced to ensure minority shareholders can, at their election, receive a fair price in any delisting or takeover scenario, even if the 90% threshold isn’t met.

- Improved Investor Education:A concerted effort is needed to educate individual investors about the risks associated with small-cap and AIM-listed companies, including the potential for illiquidity, concentrated ownership, and the impact of high debt levels. This should include clear warnings about story stocks and the importance of focusing on fundamental financial analysis, not just positive PR.

- Stronger Director Oversight and Accountability.Regulators (FRC and FCA) should be more proactive in scrutinising the actions of directors in situations where there is a potential conflict of interest between majority and minority shareholders.

- Suspension of Trading:As soon as a company’s board becomes aware of a credible plan to take the company private (or receives a requisition for a delisting vote), trading in the company’s shares on the stock exchange could be immediately suspended. This prevents informed insiders from potentially profiting at the expense of uninformed shareholders and creates a fairer environment. This suggestion is potentially contentious and its impact requires further discussion and analysis.

- Earn-Out provision:To address the potential for significant value creation after a company goes private, a mechanism could be considered to allow former shareholders to participate in this upside. This could take the form of warrants or contingent value rights linked to a future liquidity event.

Caveat Emptor:

The Gusbourne situation provides a valuable, albeit painful, lesson for investors. Several red flags were apparent:

- Controlling Shareholder:Lord Ashcroft’s dominant ownership position (66%) was a clear risk.

- High Debt Levels and Refinancing:The company’s existing high debt, followed by the January 2024 refinancing that made Lord Ashcroft the sole lender, should have been a major warning.

- The further increase in debt in October 2024, again solely financed by Lord Ashcroft.

- No Profits:Gusbourne had a history of losses, relying on future growth projections.

- Ramping and Hype:Overly optimistic pronouncements, especially in the context of continuous losses, should always be viewed with scepticism.

- Lord Ashcroft was named in the Panama Papers.

- Competitors struggling. Chapel Down lost its CEO, did a strategic review and its share price halved in 2024.

Conclusion

This case is a stark reminder of the risks faced by individual investors in the small-cap and AIM space. In my view, reforms are needed to create a fairer and more transparent environment, where the rights of all shareholders are protected, so that the UK can remain an attractive place for both large and small investors. The current system allows for the exploitation of minority shareholders, and this must change.

Footnotes:

- Gusbourne PLC. (2025, February 6). Receipt of Requisition for General Meeting. Retrieved from London Stock Exchange: https://www.lse.co.uk/rns/GUS/receipt-of-requisition-for-general-meeting-lse2eliv6f40f9f.html

- Gusbourne PLC. (2025, February 19). Notice of General Meeting. Retrieved from London Stock Exchange: https://www.lse.co.uk/rns/GUS/notice-of-general-meeting-d43y55i55ionr9f.html

- Removed – this RNS was superseded

- Removed – superseded RNS

- Gusbourne PLC. (2023, July 3). Result of AGM and update on financing. Retrieved from London Stock Exchange: https://www.lse.co.uk/rns/GUS/result-of-agm-and-update-on-financing-r89v19tjj924h44.html

- Gusbourne PLC. (2024, January 16). Commencement of Offer Period. Retrieved from London Stock Exchange: https://www.lse.co.uk/rns/GUS/commencement-of-offer-period-t38hwprm6yjbc7f.html

- Gusbourne PLC. (2024, January 19). Refinancing of Existing Loan Facilities. Retrieved from London Stock Exchange: https://www.londonstockexchange.com/news-article/GUS/refinancing-of-existing-loan-facilities/16297306

- Gusbourne PLC. (2024, September 30). Half-year Report. Retrieved from London Stock Exchange:https://www.lse.co.uk/rns/GUS/half-year-report-0el0u1irmldmbpr.html

- Gusbourne PLC. (2024, October 8). Long Term Deep Discount Bond Extension. Retrieved from London Stock Exchange: https://www.lse.co.uk/rns/GUS/long-term-deep-discount-bond-extension-kq7f5t3sve9rhjy.html

- Gusbourne PLC. (2025, January 30). Trading Statement. Retrieved from London Stock Exchange: https://www.londonstockexchange.com/news-article/GUS/trading-statement/16876049

Cliff Weight, member of ShareSoc and ShareSoc Education Committee and Policy Committee

DISCLOSURE: The author does not hold shares in Gusbourne and never has. He does hold shares in Chapel Down.

This article reflects the opinions of its author and not necessarily those of ShareSoc.

3 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

It is notable that the “free float” requirement for fully listed stocks was reduced from 25% to 10%, in a bid to attract more UK listings. As the blog illustrates, investing in a company with such a small free float is extremely risky, with small investors being at the mercy of the 90% majority.

Another example of “regulatory capture”, with regulators sacrificing sensible investor protections on the altar of demands from the financial services industry.

Gusbourne has now gone private. The last price quoted to sell shares was 10p, see https://www.lse.co.uk/SharePrice.html?shareprice=GUS&share=Gusbourne.

ShareSoc is developing its policy re delistings. Please feel free to add your comments below or email me them directly if you prefer.