Should I continue to invest in VCTs, I ask myself. Hold, Buy or Sell?

I was steered into these investments by my financial adviser, when I was busy working and never had the time to get to understand what I had bought until I retired.

So, to start my decision process, I looked at returns. Northern VCT total returns are 3.6% gross (5.1% after 30% tax relief) p.a. compound since 1995, 24 years ago when I invested. Baronsmead 3 total returns are 3.6% gross (5.9% after 30% tax relief) p.a. compound since 1998, 21 years ago when I invested. Not great but not a disaster.

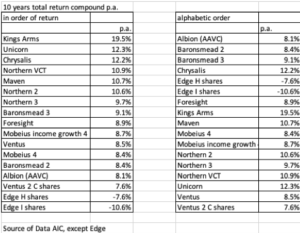

The AIC website enabled me to quickly review the returns over the past 10 years, of those companies where I hold shares. These figures are gross and annualised over the ten year period. The Kings Arms performance may look good in this table, but it was awful in the previous 10 years.

5 factors indicate future returns will not be as good as historically:

- Many asset based investments are no longer qualifying investments. These were reasonably safe, e.g. solar and wind farms. VCTs now have to be invested in higher risk companies.

- There is more money going into VCTs. More supply of capital will, all other things being equal, drive down returns.

- Pension tax relief is now severely limited. VCTs are one of the few remaining ways to reduce your tax bill, for those looking for ways to do so. Financial advisers are steering their clients into VCTs.

- Fees paid to investment managers remain high. In my opinion far too high.

- Corporate governance in many VCTs is poor. Too many directors are too closely aligned with fund managers and lack independence and a willingness to confront their investment managers. This is the main reason point 4 will persist.

These last two points have been explained further in https://www.sharesoc.org/campaigns/vct-investors-group/

My decision? I am still enjoying a healthy tax free income from these VCTs, so I won’t sell them. But I won’t invest any more in this year’s new offers.

I have however now decided to invest in the fund managers who manage VCTs, rather than the VCTs themselves. Despite my personal concerns about investing in VCTs, I think the current trends of increasingly large fund raisings and high fees for managers will continue leading to increases profits and share prices in these fund managers. I have just bought shares in Mercia, who are the new manager of the Northern VCTs. (see https://www.sharesoc.org/blog/vcts/northern-vcts-and-mercia/ for more info). I bought shares in Gresham House Strategic in June 2017 @911p and March 2018 @828p. Gresham manage Baronsmead VCTs and are now trading at 1275p, so a healthy gain so far.

Disclaimer: I own shares in all the above companies. I am not qualified to give advice and do not take any of the above as advice or a recommendation.

Cliff Weight, Director, ShareSoc