This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

By Cliff Weight, ShareSoc Director

Please note I am not qualified to give investment advice, and nothing in this blog constitutes advice.

Overview

Chris Spencer Phillips reported in a recent blog https://www.sharesoc.org/blog/investment-strategies/a-review-of-my-2020-share-portfolio-chris-spencer-phillips/ that his portfolio was up +80% in 2020, after being + 25% in 2019. Congrats and hats off to Chris. I cannot rival that, but I thought readers might find my review of 2020 of interest.

My portfolio numbers for 2020 were:

Everything – all equities, ISAs, SIPPs, OEICS, etc +3%

Cliff’s portfolio F (the ones I actively manage. These are mainly

small cap and AIM, i.e. growth shares) +44%

OEICS – these are mainly overseas/global funds +12%

ISA (badly affected by BP and Shell, but lots of goodies) +5%

My benchmark = FTSE 100 -14%

Core portfolio

My portfolio of investments is mostly conservatively invested. I started investing in 1984 and I have a very diversified portfolio of mainly UK FTSE100 companies, that I tend to buy and hold. I rarely trade. I sometimes buy some more. My primary focus is on risk and preservation of capital.

My big investment decision was in 1997 when Labour (Blair) was elected and I decided (correctly) that I should diversify much more of my investments overseas. I did this by buying a range of unit trusts and investment trusts. This has been a very good long term decision and this part of my portfolio was up by 12% in 2020.

I was about 15% cash and this returned a tiny amount of interest. Cash in your portfolio is (in effect) an option to short the market, as it allows you to buy in at a lower price if the market declines. Without cash you cannot do so. Cash enables you to buy bargains. No cash means you cannot afford to buy the bargains. I had about 15% of my investments in cash at end March. I wished I had more. I now have about 10% cash.

In my core portfolio, I have large positions in BP and Shell and these did poorly in 2020. But 3i and Unilever held up well. My shares in Schroder Mid Cap Investment Trust did well, helped by the discount narrowing – it was 20% when I bought them in 2016. I also hold Supermarket REIT, which I regard as a very safe investment with good yield. I bought Strategic Equity Capital in the Autumn as they had a very large discount to NAV and so far I have made a nice profit on them. Murray Income Trust is another biggish position and this did not do very well in 2020, as Value was out of favour.

My approach is both top down and bottom up.

Top down, I think about asset allocation. How much in cash and how much in each sector.

I have always avoided tobacco (tobacco kills people), guns and defence (they kill people), doorstep lending at high rates (preying on the weak and needy is a bad thing).

When the ravages of Covid emerged I thought carefully what to do (see https://www.sharesoc.org/blog/discussion-paper-what-do-we-do-now-covid-19-implications/ ). I sold Berkeley Homes, Persimmon and Barratt Homes and don’t have any building shares, for the reason that house prices and the volume of transactions will crash. I have some building infrastructure companies as long term these will be needed in the recovery. I avoided Travel companies, Hotels, Pubs and Retail (except I hold Tesco, which is an exception).

I decided we will still need the basics of life, air, water, heating, electric, food, wine, pharmaceuticals, food retailers, food manufacturers, wifi, broadband, etc.

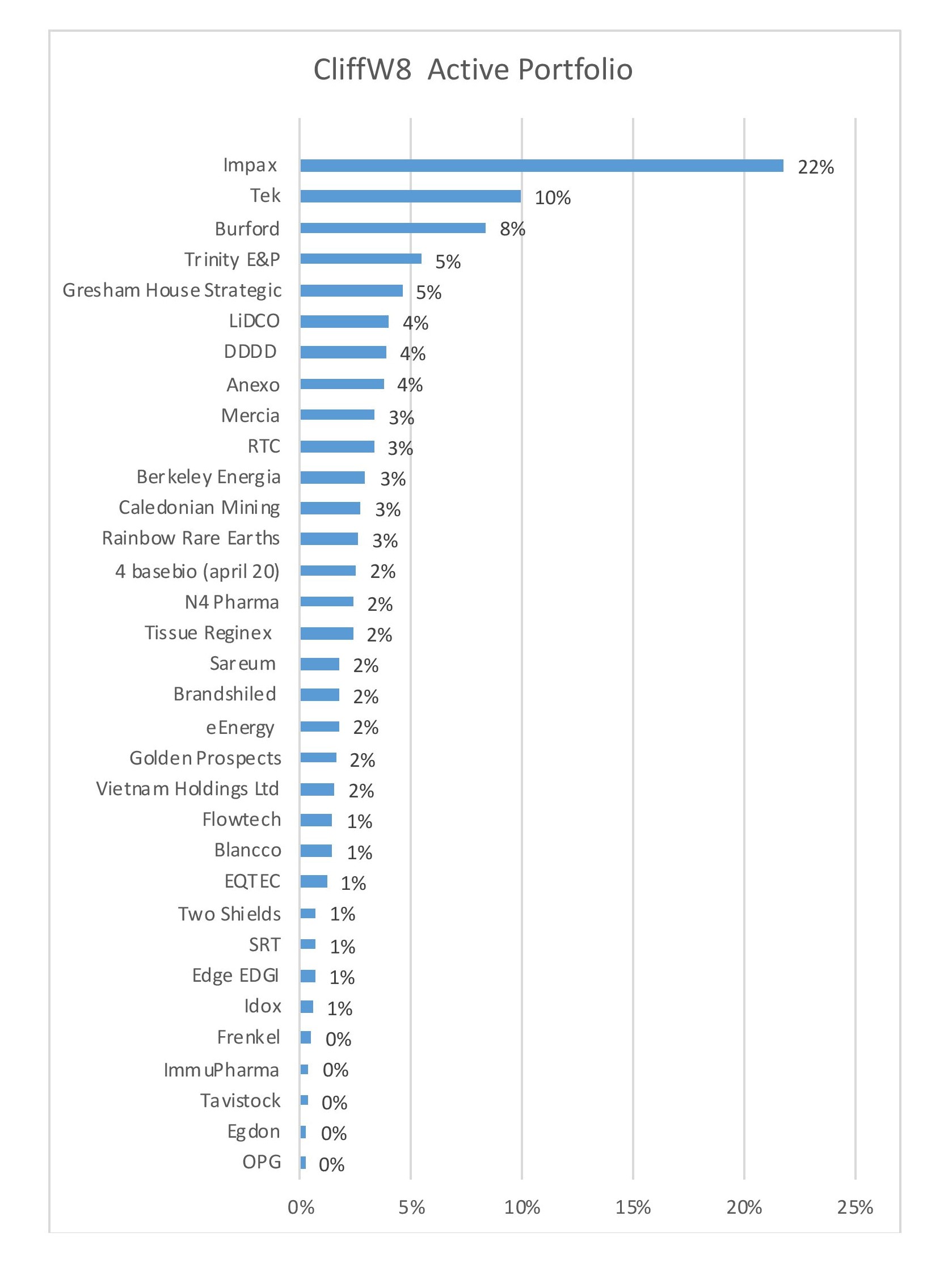

Portfolio F

I retired in 2016 and as a new hobby started a “Fun Portfolio”, which I shall refer to as PORTFOLIO F. I allocated 5% of my investments to this. It consists of growth companies, mainly Small cap and AIM. In March 2020, Portfolio F was a sea of red, but it recovered very well and finished the year at +44%.

I was very pleased at this, as I benchmark myself against the FTSE 100 which went down 14%. So I had beaten the index by 58%.

What drove it were large positions in Impax, Burford and Tekcapital. My position in Impax is arguably far too large, but I bought it in 2017 and 2018 and it has done wonderfully well. I have followed Impax closely and still think it will grow further. I might sell 20-25% of my holding, but I plan to hold it for the long term. Tek is another long term holding. It is highly volatile. I was annoyed when they did a placing at mates rates and I was not asked to participate. But I think they have a range of good investments and a process for getting more in the pipeline that seems to work. Burford was a new investment in 2020 and was up about 40%.

I have a long tail of investments. Partly these are previous failures that I have not sold. Some I continue to watch and I nearly topped up on Egdon a few days ago, but then the price shot up and I missed the chance. I tend to buy small amounts and watch the company for a few months or years before I buy more. It is rare that I make a big investment to start with.

I source my investments mainly from companies that present at ShareSoc, or at Mello and from a few Twitter friends I follow (@DonaldPond6, @Marben100, @AstonGirl, @MrContrarian, @Boros10, etc). I read voraciously and am very aware of my biases and weaknesses, my echo chamber and filter bubble. I know I have a tendency to believe what I am told and buy too many shares that are tipped. I subscribed to Stockopedia in 2020 and wish I had done so much earlier – it has lots of info easily accessible and helps me do quick analyses of whether to buy or sell companies. I signed up to Turner Pope and have been very selective in which of their placings/IPOs I invest in and have had some really nice profits on quite small investments, e.g. Rainbow Rare Earths, Eenergy, Brandshield, Iron (which I sold too early!). I also made some small profits from subscribing to Primary Bid placings. I also subscribe to ShareProphets and tend to sell if I have any shares in companies that Tom rubbishes – he is also a good counter for my innate over optimism! I read the FT and Daily Mail (the latter is free and has many good Money stories).

My main decision later in 2020 was to increase my exposure to gold and precious metals. I listened to the Mello Gold webinar in November and this convinced me to allocate 1% to 5% of my total portfolio to this area. Most of these investments are in Portfolio F.

I also hold a few pharma companies. 4D Pharma was a new investment in 2020.

Since the year end, I have added Jubilee Metals, Manolete and Anglo Asia Mining.

I spend most of my investment time on Portfolio F, which is now nearly 10% of my investments.

I don’t own Bitcoin. I suspect it is a bubble. I don’t understand it and I don’t wish to spend huge amounts of time learning about it. Not owning it makes it easier to sleep at night. I mostly avoided the dot.com boom bubble, LTCM and the CMO/CLO financial bubble that burst in 2007/08.

I expect my main portfolio to remain very conservatively invested with little trading activity. I cannot sell my OEICs, and investments trusts as if I did I would have to pay large capital gains tax, so unless they underperform badly I will stick with them.

My friend Amin, has recently taught me about home country bias and I now realise I am guilty of this. Being overweight UK, has considerably impacted (negatively) my investment performance overall in 2020 and for the past 20 years+. The Global market index benchmark was up by +13.5% in 2020. I am tempted to address this bias, but feel that post Brexit, the UK market may be due for a bounce and to some extent this has already started in early 2021.

5 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

Thank you for the kind mention.

At its most basic, home country bias is a version of putting all of your eggs in one basket. There is no reason to expect the country you live in to have the most desirable stock market to invest in. Choosing from the largest possible universe of shares is likely to result in a better portfolio.

There are of course practical issues to look at, but investing in USA or EU shares is generally as easy as UK shares. For other locations there are collective investment schemes.

Hi Cliff, thanks for sharing

With this comment:

” I cannot sell my OEICs, and investments trusts as if I did I would have to pay large capital gains tax, so unless they underperform badly I will stick with them.”;

I wonder if you would consider selling a partial amount per tax year, in order to make use of the yearly CGT allowance (£12,300 for individuals). It may help to move some exposure into an ISA, if you are not making full use of your ISA allowance 🙂

Thanks,

Andy

https://www.which.co.uk/money/tax/capital-gains-tax/capital-gains-tax-allowances-and-rates-a0muq0c65cd7

AndySav is right. Always makes use of your £12,300 tax free cgt allowance. It is very important to do so this year before the budget, if you think the Chancellor may reduce/remove this allowance.

It is also prudent/sensible tax planning to maximise your ISA investments and SIPPs. Don’t forget that you can gift money to your children and grandchildren so they can maximise their ISAs, SIPPs and LISAs and children’s JUNIOR ISAs.

It is also important to write a will (sorry to be morbid, but none of us are immortal 🙂 ) and to plan IHT.

Cliff, absolutely agreed that you should always make use of your £12,300 tax-free CGT allowance.

I did that for decades, which also allowed me to gradually transfer much of my portfolio into my ISA.

However, various factors meant that, despite this, there came a point a few years ago when my non-ISA, non-SIPP annual gains started running well ahead of my CGT allowance, and it became clear that I would increasingly risk incurring higher-rate CGT in future years as a result.

So I moved over to using capital gains to bring me up to my higher-rate threshold. Yes, I pay 10% on the gains, but I would rather pay 10% now than 20% in future – or considerably more than 20% if CGT rates are raised.

And, frankly, 10% of profits is not a lot to pay for the government services from which we all benefit.

Finally, I have now reached the point where I can make significant Gift-Aided charitable donations each year, and these increase my higher-rate threshold by 1.25 times the value of the donations; so for every £1,000 that I donate I can burn off another £1,250 in capital gains at a 10% tax cost.

If you’re charitably inclined, that’s a very decent incentive.

Cliff, thank you for your kind comments on my share portfolio in 2020. I found the review of your portfolios most interesting – so many different approaches and strategies! I do find it strange that you persist with large FTSE dinosaurs who are unable to trot let alone gallop and are increasingly falling out of favour with larger investors. I would advise using tax free spread betting when you feel positively about a company and it’s prospects – it should be used sparingly tho!.