This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

This week’s Investors Chronicle edition (dated 28/12/2018) provides lots of food for thought. One of the most educational is their review of the share tips they published as “tips of the week” in 2018. Unlike some investment publications, who simply forget about their past tips that go nowhere, while lauding their hits, the IC is open about their performance.

They issued 173 “BUY” tips and 24 “SELL” tips in the year. That is quite some achievement by itself as I rarely have more than a very few good new investment ideas in any one year and tend to hold most of my investments from year to year.

How did their tips perform? Overall the “BUYs” returned minus 11.5% which they calculate as being 0.9% better on average than the relevant index. Hardly worth the trouble of investing in them bearing in mind the need to monitor such individual share investments and the transaction costs. The “SELLs” did better at -18.0% versus an index return of -8.8%.

The BUYs were depressed by some real howlers. Such as tipping Conviviality shortly before it went into administration, although they did reverse that tip to a “SELL” before it did so. The result was only a reported 12% loss. As a consequence they are making some “fundamental changes to the way we recommend shares”.

But with so many share tips, the overall performance was not impacted by one or two failures and tended to approximate to the overall market performance. Which tells us that you cannot achieve significant over or under performance in a portfolio by holding hundreds of shares.

I don’t work out my overall portfolio performance for the year until after it ends on the 31st December so I may report on it thereafter. That’s if it’s not too embarrassing. With many small cap technology stocks in my portfolio, I suspect it won’t be good. I always look at my individual gains and losses on shares at the year end, as an educational process. As Chris Dillow said in the IC, “Investing like all our dealings with the real world, should be a learning experience: we must ask what we got wrong, what we got right, and what we can learn. The end of the year is as good a time as any for a round up…”.

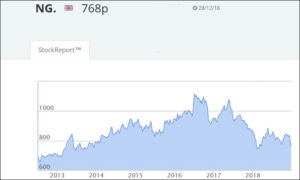

One BUY tip they made was National Grid (NG.) in May 2018 on which they lost 11.8%. There is a separate article in this week’s IC edition on that company which makes for interesting reading as a former holder of the stock. I sold most of my holding in 2017 and the remainder in early 2018 – that was probably wise as you can see from the chart below (courtesy of Stockopedia).

National Grid has a partial monopoly on energy distribution and always seemed to be a well-managed business. Many investors purchase the shares for the dividend yield which is currently about 6%. But the IC article pointed out that proposals from OFGEM (their regulator) might limit allowed return on equity to 3%, which surely threatens the dividend in the long term. The share price fell 7% on the day that OFGEM announced their proposals. Bearing in mind the risks of running an electricity network, and the general business risks they face, that proposed return on equity seems to be completely inadequate to me. That’s even if one ignores the threat of nationalisation under a possible Labour Government.

Another IC article in the same edition was entitled “Brexit and the UK Economy”. That was an interesting analysis of the UK economy using various charts and tables. One particularly table worth studying was the balance of trade between the UK and our main trading partners. We have a big negative balance (i.e. import more than we export) to Germany, Spain, Belgium, Holland and Italy but positive balances with Ireland and the Rest of the World – particularly the USA. The article makes clear that our trade with EU countries has been declining – exports down from 55% in 1999 to 44% of all exports. But imports have not fallen as much so the trade gap has been widening. Meanwhile our exports to Latin America and China, which have been good economic growth areas, have remained relatively small.

The conclusions are simple. EU economies such as Germany would be severely hit by any trade disruption on Brexit. But opportunities in rapidly growing markets are currently being missed, perhaps hampered by inability to negotiate our own trade deals with them, and that might improve after Brexit.

Audit Market Review

The Competition and Markets Authority (CMA) have published an “Update Paper” on their review of the audit market. It contains specific recommendations on changes to improve competition and asks for comments. See https://assets.publishing.service.gov.uk/media/5c17cf2ae5274a4664fa777b/Audit_update_paper_S.pdf .

It mentions a long list of audit failings on pages 12 onwards including banks before the financial crisis of 2008, BHS, Carillion, Autonomy (covered in a previous blog post) and Conviviality which was mentioned above.

This paragraph in their executive summary is worth repeating: “Independent audits should ensure that company information can be trusted; they provide a service which is essential to shareholders and also serves the wider public interest. But recent events have brought back to the surface longstanding concerns that audits all too often fall short. And in a market where trust and confidence are crucial, even the perception that information cannot be trusted is a problem.”

One problem they identify is that “companies select and pay their own auditors” which they consider an impediment to high-quality audits. In addition choice is exceedingly limited for large FTSE companies, with the “big four” audit firms dominating that market.

Their proposals to improve matters are 1) More regulatory scrutiny of auditor appointment and management; 2) Breaking down barriers to challenger firms and mandatory joint audits; 3) A split between audit and advisory business within audit firms and 4) Peer reviews of audits.

Their review of FRC enforcement findings suggests that the most frequent findings of misconduct include:

(a) failure to exercise sufficient professional scepticism or to challenge management (most cases);

(b) failure to obtain sufficient appropriate audit evidence (most cases); and

(c) loss of independence (three out of a total of 11 cases).

That surely indicates a major problem with audit quality, and that is backed up by the FRC’s own analysis of audits that they have reviewed with only 73% being rated as “good or requiring limited improvement”.

Auditors are primarily selected via audit committees and there is a noticeable lack of engagement by shareholders in their selection. But that’s surely because large institutional shareholders have little ability to judge the merits of different audit firms.

Would more competition improve audit quality, or simply cause a focus on the lowest price tenders? The report does not provide any specific comment on that issue but clearly they believe more competition might assist. More competition does appear to drive more quality for a given expenditure in most markets however so it is surely sensible to support their recommendations in that regard. The report does emphasise that the selection and oversight of auditors would ensure that competition is focused on quality more than price which is surely the key issue.

A previous proposal was that auditors be appointed by an independent body but that has been dropped, partly due to shareholder opposition. The new proposal is for audit committees to report to a regulator with a representative even sitting as an observer on audit committees where justified. In essence it is proposing much more external scrutiny of audit committee activities in FTSE-350 companies and decisions taken by them.

The end result, at some cost no doubt, would be that both auditors and audit committees will be continually looking over their shoulders at what their regulators might think about their work. That might certainly improve audit quality so for that reason I suggest this proposal should be supported.

The requirement for “joint” audits where two audit firms including one smaller firm had to be engaged seemed to be opposed by many audit committee chairmen and by the big four accounting firms. Some of their objections seem well founded, but the riposte in the report is that evidence from France, where joint audits are compulsory, suggests they have a positive impact on audit quality. Moreover, it would clearly increase competition in the audit market.

In summary, the report does appear to provide some sound recommendations that might improve audit quality. But investors do need to respond to the consultation questions in the report as it would seem likely that the big audit firms will oppose many of them.

Roger Lawson (Twitter: https://twitter.com/RogerWLawson )

4 Comments

Leave a Comment Click here to cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.

It’s funny how two people can see the same data and reach very different conclusions. You claim “EU economies such as Germany would be severely hit by any trade disruption on Brexit.” But Germany’s exports to the UK form just 6.6% of German exports (see https://tradingeconomics.com/germany/exports-by-country ) whereas the UK’s exports to the EU comprise 44% of our total (over 60% if you include 3rd countries covered by trade agreements with the EU that would need to be replaced if we leave the customs union). Any deal that involves the UK leaving the customs union, thus creating trade frictions with the EU. will be a lose-lose for both parties – but with the UK likely to be much more severely impacted than any single EU country.

You also say: “But opportunities in rapidly growing markets are currently being missed, perhaps hampered by inability to negotiate our own trade deals with them, and that might improve after Brexit.” This seems highly unlikely to me. The reason that our companies find it difficult to trade with rapidly growing economies (such as China) is that dealing with these economies is very difficult, hampered by an unreliable legal environment (I have seen a recent report of a company finding it impossible to enforce contractual payment terms in Chinese courts), very different cultures and business conditions, as well as physical distance.

I do not find it remotely credible that the UK, a country of < 70m people will be able to negotiate better trade terms than the largest economic bloc in the world, the EU with a population of 500m and a GDP of $19tn vs the UK's $2.6tn. The reason that the EU has not yet been able to negotiate deals with certain countries is that the EU considers that the terms being offered would not be in its citizens' interests. A good example is the proposed TTIP agreement with the US: the leave campaign claimed that the EU was about to sign this deal, which would reduce food standards and force the UK government to open the NHS to competition from US healthcare firms. The opposite is the case: the EU will not sign such an agreement, precisely because of the concerns raised by the leave campaign. Do you seriously think the US is likely to offer better terms to the UK, or use our desperation to agree new deals to force precisely those terms on us?

Mark Bentley

It is undoubtedly true though that we have a big trade deficit with the rest of the EU – see https://fullfact.org/europe/uk-eu-trade/ . So who would be most hurt if that trade is made more difficult or costly? The EU surely. One has to look at the whole of the EU not just individual countries and I only mentioned Germany as one country that would be substantially affected.

You are undoubtedly right about the difficulties of doing business in China or any other far distant countries. But some companies seem to be able to do so without problems. It’s not just about tariff barriers which are probably a relatively minor issue but still may be significant.

Whilst in absolute terms the total impact on the EU may be larger, relative to the size of the respective economies (which is what counts in terms of impact on GDP growth and per capita income) the impact on the UK is far larger.

There is an interesting paper here: https://www.dihk.de/ressourcen/downloads/brexit-umfrage-02-18-engl.pdfhttps://www.dihk.de/ressourcen/downloads/brexit-umfrage-02-18-engl.pdf discussing the impact of Brexit on German business showing a) how German business expects to mitigate the impact of Brexit by shifting investment out of the UK back to Germany or to other EU27 countries, despite the impact being significant. b) how this negatively impacts the UK [already evident by our GDP growth slowing from the quickest in the EU to the slowest of the major economies]. c) that preservation of the single market and its integrity is more important to German business than UK trade (contrary to the leaver myth that EU business will put pressure on EU negotiators to make exceptions for the UK in order to preserve their exports). It is clear that the EU will not allow the UK to “have its cake and eat it” as doing so would damage the integrity of the single market, which is of overriding importance. See this for a realistic understanding of the EU’s negotiating position: https://news.liverpool.ac.uk/2018/12/13/full-speech-sir-ivan-rogers-on-brexit/

I am glad you recognise that tariff barriers are the least of the issues facing UK business if/when we leave the EU (contrary to most media chatter and leaver campaigning) and that other frictional factors will have a more significant impact on trade and investment.

Can we just agree that a Brexit withdrawal agreement that continues to support “frictionless” trade between the UK and EU is in everyone’s interest? I was just pointing out that it is just as much in the EU’s interests to do that, if not more so, than it is in the UK’s. It would certainly not be wise to go for a “no deal” Brexit if it can be avoided. I think that is Mrs May’s stance also.