This blog gives you the latest topical news plus some informal comments on them from ShareSoc’s directors and other contributors. These are the personal comments of the authors and not necessarily the considered views of ShareSoc. The writers may hold shares in the companies mentioned. You can add your own comments on the blog posts, but note that ShareSoc reserves the right to remove or edit comments where they are inappropriate or defamatory.

Money Maze Podcast – Kintbury Capital’s Long-Short European Equity Strategy with Chris Dale, Founder & CIO

I was lucky enough to be playing golf with Chris Dale early in January and shared a beer afterwards. We talked a little bit about investing and Chris suggested I might like to listen to his podcast. When I got home, I did and found it fascinating. So many insights. I hope others will find it both enjoyable and educational.

People like Chris make rare appearances in public, so take advantage of this opportunity to learn from his 53 minute podcast. Best of all is that there are only 2,903 views of this YouTube podcast, so far. So, you will be getting ahead of many other investors, if you listen to all 53 minutes.

In my working career I was a remuneration consultant and designed numerous incentive and remuneration schemes for hedge funds and traditional funds. My old firm, MM&K, runs the leading remuneration survey of the Private Equity and Venture Capitial Industry, so, I know quite a bit how the industry works.

Hedge Fund Managers are the crème de la crème of the fund management industry. The top ones make billions. The 2+20 model (2% of AUM plus 20% of outperformance above a hurdle) means very high fees and high pay for successful hedge fund managers and their investors are happy to pay these fees. According to Investopedia, the five highest-paid hedge fund managers are Ken Griffin, the founder of Chicago-based Citadel with personal earnings of $4.1 billion, Izzy Englander of Millennium Management with $3.2 billion, Steven Cohen with $1.9 billion, David Tepper with $1.2 billion and James Simons with $1.1 billion (most of these figures relate to 2022). Fund managers in the traditional long only space make nothing like these amounts. That is why the good ones leave and move to Hedge funds or Private Equity where the pay is so much better.

Academic research into traditional fund managers shows that over the long term almost all underperform the index yet charge quite high fees for this “service” to customers. The press often fawns over traditional fund managers (the classic example being Neil Woodford in the 2010-2017 period) and there seems to be an industry devoted to promoting fund managers and their wares to under-educated consumers. I see part of ShareSoc’s role as improving education about funds, fees, performance and risks.

Traditional fund managers seem to be able to survive, often despite quite moderate performance for their investors. Managers often manage more than one fund, and the underperforming ones tend to get closed or merged. There is a lot of survivorship bias in the performance data presented by the industry. The real skill (as the CEO of one well known star fund manager told me) is in marketing – it is easy to buy in fund managers but the real added value is attracting investors in funds.

In contrast to the soft and relatively comfortable traditional long only space, the hedge fund world is tough. Few hedge fund managers survive over the longer term. The average lifetime of a hedge fund is now reportedly less than 4 years.

Chris Dale is a seasoned investor in this high-octane space with an impressive long-term track record. He has survived 20 years, first at Millenium, which he left to set up his own business Kintbury. He now runs about £1.4 billion.

In this podcast, he explains Kintbury’s approach, which offers an exposure to a universe of listed UK and European companies without exposing investors to directional market risk or “beta”. Chris explains how they identify short and long opportunities, including why they shorted Wirecard, and why they have been long Novo Nordisk for many years. He discusses the egregious price inflation in luxury goods.

He then explains their warning flags on the short side, and how sustained cash generation sits high on their list of priorities for their long investments.

The fund aims to hold long share positions for 2 to 3 years and short positions for up to one year

TOPICS:

0:00 – Introduction

1:19 – Chris’s Background

3:19 – Transitioning to Finance

5:21 – Time at Millennium & Warburgs

7:20 – Setting Up Kintbury Capital

8:28 – Kintbury Capital Overview

9:32 – UK/Europe Focus Only

12:33 – Compounding

14:05 – Investment Process

15:40 – Long Side (Novo Nordisk & Colruyt)

19:51 – Short Side (Wirecard)

27:00 – Types of Shorts

29:42 – Migration to Buy Side

31:30 – Value Spread in European Equities

34:37 – Typical Investor Client Types

38:01 – Fund Performance

38:57 – Five Year Plan

40:17 – Lessons Learnt

44:41 – Europe Luxury Sector Slowdown?

47:38 – Why Sports Is Like Investing

50:40 – Conclusion

His point about compounding, I found particularly compelling. A successful company with a 20% or 30% ROI can reinvest in its business and over the long term grow significantly. Companies who run out of ideas on where to invest in their existing businesses often go on an acquisition spree which destroys shareholder value.

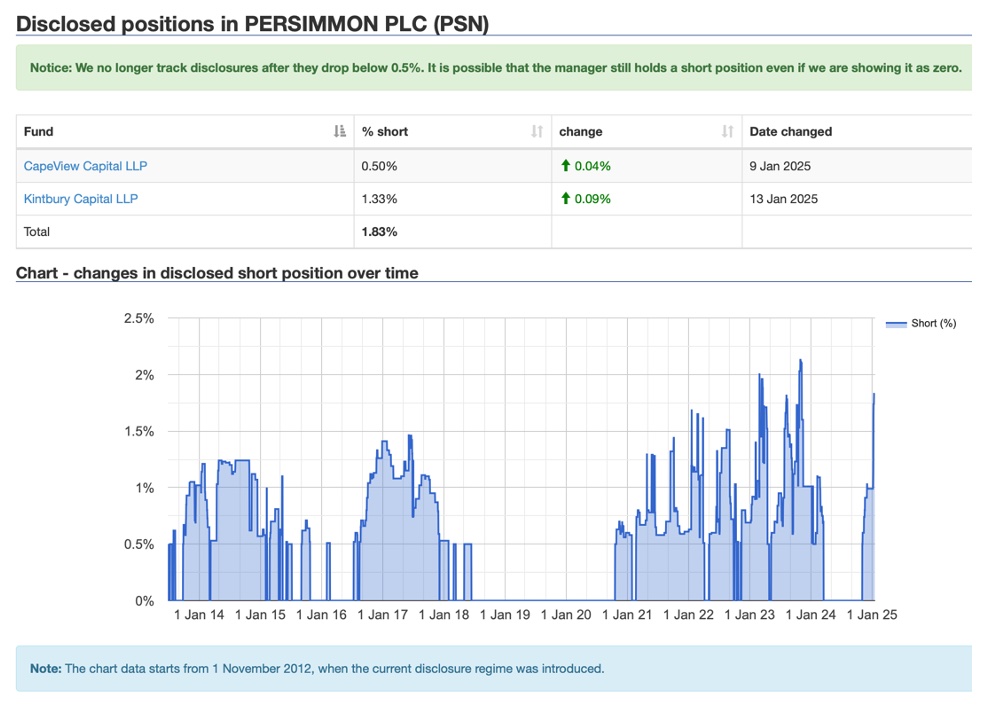

You can identify Chris’s short positions in UK shares via short trackershort tracker. Currently they are:

| Company | % short | Change | Date changed |

| KINGFISHER PLC | 0.93% | 0.05% | 19 Dec 2024 |

| PERSIMMON PLC | 1.33% | 0.09% | 13 Jan 2025 |

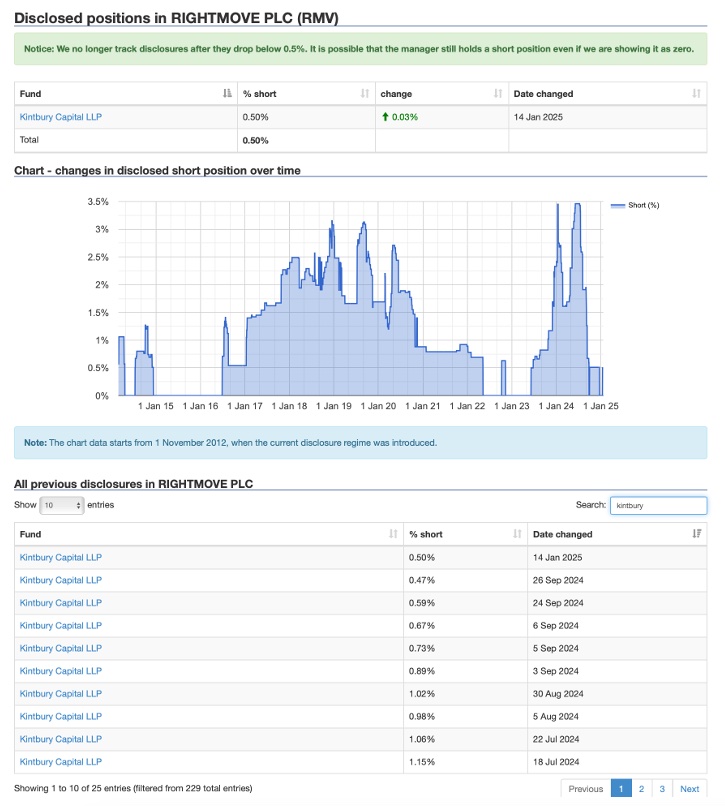

| RIGHTMOVE PLC | 0.50% | 0.03% | 14 Jan 2025 |

| SCHRODERS PLC | 0.59% | -0.02% | 14 Nov 2024 |

| Vistry Group PLC | 1.05% | -0.10% | 7 Jan 2025 |

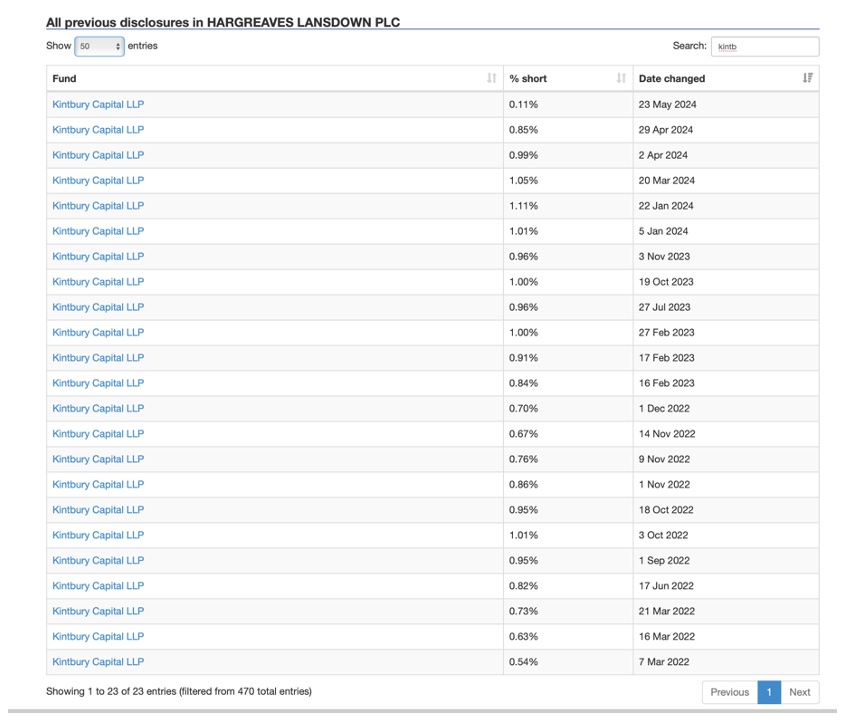

He was recently short of Hargreaves Lansdown, see https://www.thetimes.com/article/point72-fund-joins-short-sellers-targeting-hargreaves-lansdown-btrwlzkmv . His argument was that it is a structurally challenged business, that charges customers more than is necessary and profits will collapse.

It is interesting looking at the history of the short position and the share price.

Chris opened his short position in March 2022, increased it, then reduced it several times and then rapidly exited in April / May 2024:

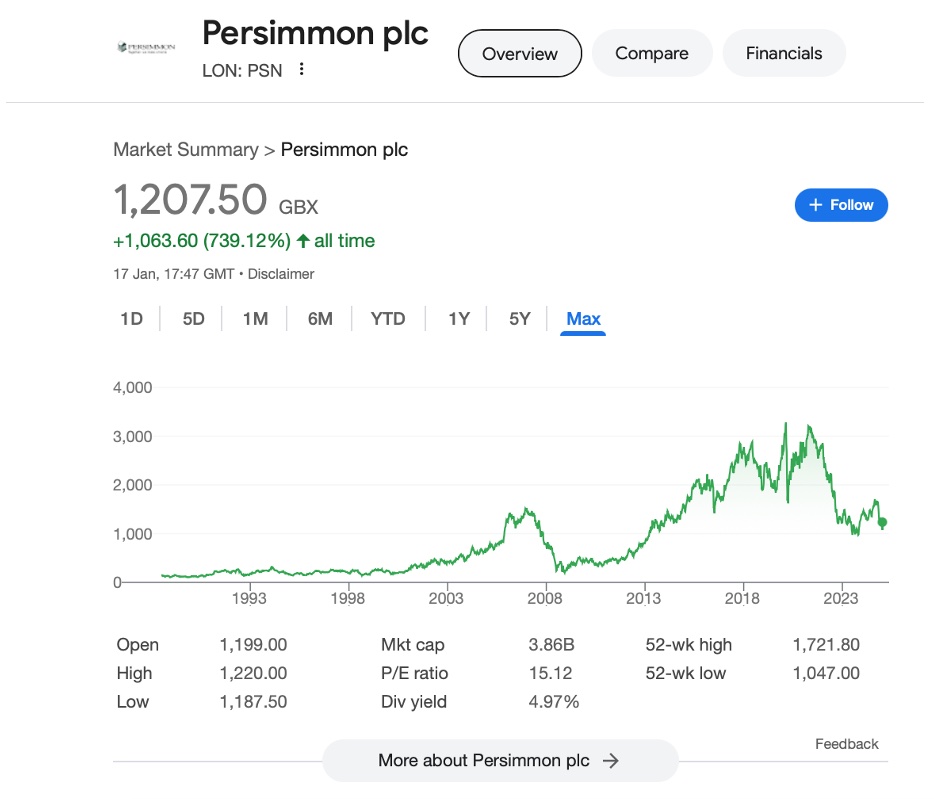

Persimmon

I know quite a bit about Persimmon. I bought them at about £6.80 in 2012 and sold out in 2020 at about £28. Chris thinks their profit margins will come under pressure.

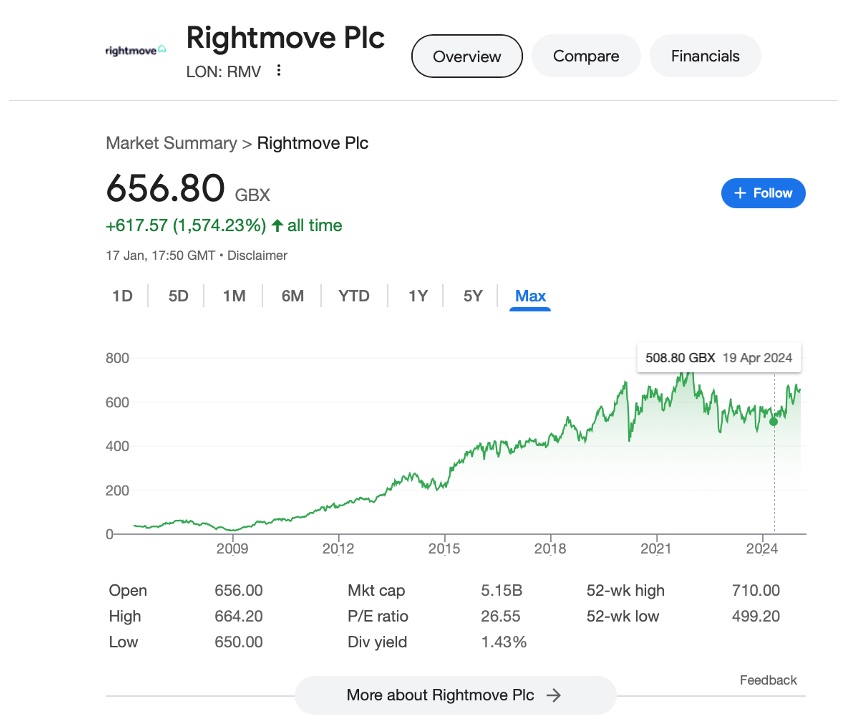

RightMove

Kintbury had a >1% short position in mid 2024 but reduced it (took profits).

Nothing in this blog should be construed as financial advice. Financial advice requires knowledge of an indivual’s financial circumstances and the payment of a fee.

Cliff Weight, member of ShareSoc Education and Policy Committees

The author does not hold shares or a short position in any of the companies mentioned.

This article reflects the opinions of its author and not necessarily those of ShareSoc.

This site uses Akismet to reduce spam. Learn how your comment data is processed.

- EDUCATION

- MEMBERSHIP

Digital Marketing by Chillibyte.