Vietnam Enterprise Investments opportunity

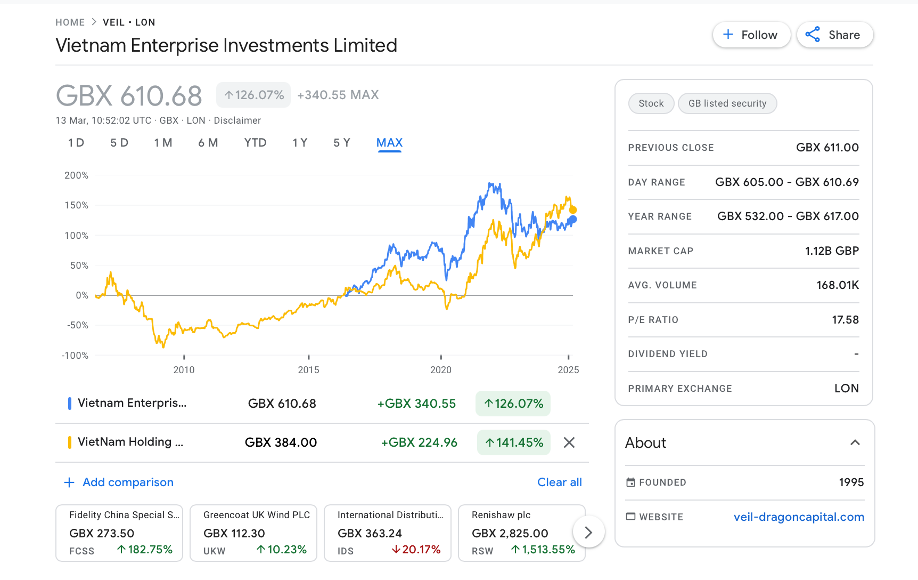

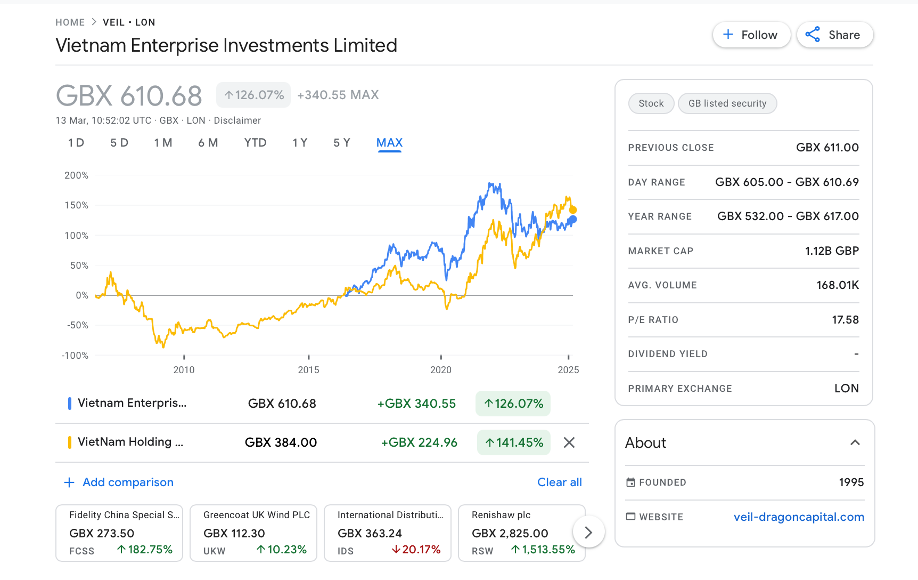

On 13 March I listened to a very interesting webinar on Vietnam “Vietnam Enterprise Investments | Kepler Trust Intelligence Ideas for your ISA”, https://www.youtube.com/watch?v=DO694HbHyVI&t=42s . I visited Vietnam in 2019 on holiday and found it fascinating, so put a bit of money into Vietnam Holdings (VNH), which has given me a very good return of 103% so far. I bought some VEIL after the webinar.

VEIL is on a discount of 20% which looks too high to me, given it is mainly invested in quoted liquid stocks and the Board are making a number of actions to manage the discount down. I asked a question at the webinar about the discount and got a satisfactory answer. It has been lower, so a long-term buying opportunity. VNH is on a 4% discount.

VEIL is much bigger than VNH, £1.4bn v. £0.4bn, so with its 1.96% fee can afford to employ quite a few expert fund managers.

A repeat of the webinar can be watched via the Kepler Website https://www.trustintelligence.co.uk/investor/articles/ideas-for-your-isa-retail-feb-2025

https://www.trustintelligence.co.uk

This article reflects the opinions of its author and not necessarily those of ShareSoc.

Cliff Weight, Member ShareSoc and ShareSoc Education and Policy Committees.

DISCLOSURE: The author holds shares in VEIL and VNH.

Probably one of my worst timed buys and certainly my worst timed blog. Due to tariffs, of which Vietnam seems to have been particularly badly treated, VEIL is down 25% since I bought. (At least, VHN is still 40% up on my 2019 purchase price, despite its recent drop.)