In the first week of August, global stock markets sold off sharply – but what was driving that correction? Ram Sachdev highlights the pivotal role played by the ‘yen carry trade’

The recent market correction (defined as a decline of more than 10%) has raised questions among investors as to what underpinned the sell-off. One key factor was the role played by the yen carry trade at that time.

What is a carry trade?

A carry trade is a financial strategy in which an investor borrows funds in a currency with a low interest rate to acquire assets denominated in another currency with higher rates, with the objective of generating a positive net return.

A notable example is the yen carry trade that emerged due to Japan’s historically low interest rates, a consequence of its stagnant economic conditions. This situation allowed investors to borrow yen at minimal cost and invest those funds in US assets at higher yields.

This strategy relies on currency values remaining stable. Fluctuations in the value of the yen have the potential to diminish profits. Traders often employ leverage (borrowing money to invest) in order to amplify their potential returns.

The yen strengthens

The recent appreciation of the Japanese yen can be attributed to hawkish statements from Bank of Japan officials around potential interest rate hikes. For the first time in 17 years, the central bank has raised interest rates into positive territory. Typically, rising interest rates bolster a currency’s value as investors seek to capitalise on higher returns.

Additionally, the Bank of Japan is probably intervening in the currency market to support the yen to suppress import costs. Given Japan’s status as a resource-scarce nation, maintaining affordable import prices is important.

Conversely, the US Federal Reserve is expected to begin reducing interest rates, a move supported by recent weak data from the US labour market. This is expected to result in a decline in the value of the US dollar.

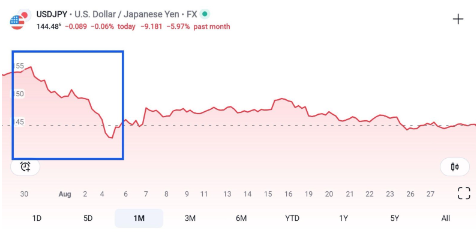

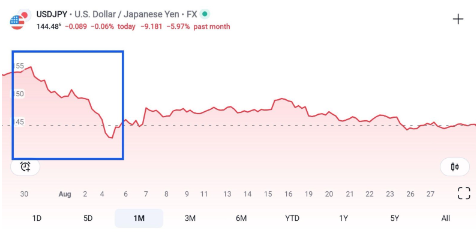

In this chart we can see the USD weaken compared to the yen around the start of August, likely causing an unwind of the yen carry trade (Source: Tradingview.com).

Traders face margin calls

As market losses began to accumulate, some investors faced margin calls from their lenders, prompting them to liquidate assets to meet their loan obligations. This selling pressure further exacerbated stock declines, creating a feedback loop that compelled more investors to sell as their assets continued to depreciate.

Compounding this situation was a prevailing negative narrative from bearish investors (those anticipating a market downturn), who pointed to a single disappointing economic indicator report as evidence that the US was heading toward recession. These bearish investors probably profited from short-selling, which incentivised them to promote the market decline. This sentiment also provided a rationale for other investors to realise profits on previously strong asset gains, contributing to increased selling activity and further market declines.

However, as reports emerged indicating that the US economy was in a healthier state than the bears suggested, buyers began to enter the market to ‘buy the dip’, positioning themselves to benefit from the anticipated recovery in asset values.

In conclusion, the unwinding of the yen carry trade appears to have played a significant role in precipitating the market correction observed in early August 2024. Nevertheless, this alone does not account for the entirety of the market correction. It is plausible that investors were seeking an opportunity to realise profits following a robust recovery from previous lows.

Furthermore, bearish sentiment was prevalent, fueled by narratives of a potential US recession, which were substantiated by a disappointing US labour report. This contributed to a heightened negative sentiment, exacerbating the selling pressure. It was only after the release of a positive US economic report, which indicated that the US economy was in a healthier state than previously feared, that buyers re-entered the market to buy the dip and capitalise on the lower stock prices.

Ram Sachdev is a director of ShareSoc