I recommend shareholders vote against the Remuneration Report at the Lloyds AGM on 16 May 2019, because the proposal to pay the CEO a pension allowance of 33% of salary has attracted huge negative publicity. It has become a significant distraction and has negatively impacted the brand.

The HBSC CEO accepted a reduction in his pension from 35% to 10% of salary. Antonio Horta-Osorio should have accepted the same, i.e. a 10% pension. The difference would be £293,000 year, but this is small beer in comparison to the £51 million Osorio has received since he was recruited in 2011. Osorio has accepted a reduction from £573k to 419k, but this is not enough.

Either Antonio Horta-Osorio is being poorly advised as to the negative impact of this, or he is exceedingly greedy.

Those who can remember 2011, will recall that Lloyds was in a mess and it was proving difficult to hire a good CEO. Antonio Horta-Osorio negotiated a good deal and has been paid £51 million so far, with quite a lot more to come. However, the political climate around high pay, and pensions in particular, has changed. Antonio Horta-Osorio needs to recognise this or leave. (Ross McEwan has decided to leave at RBS. Ross refused to reduce his pension earlier this year, and then announced at the RBS April 25 AGM that he was leaving RBS.)

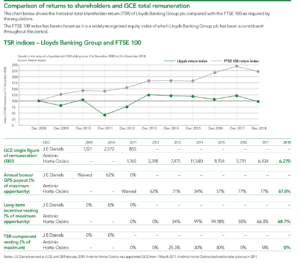

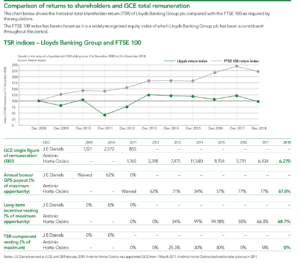

A second reason to vote against is the high payout of bonus and LTIPs, compared to the lack of progress in TSR.

A third reason is that Lloyds is now a much simpler, safer bank than in 2011. Almost all the legacy issues have been dealt with. A new CEO could be recruited at a much lower rate of pay.

Lloyds annual report page 90, shows his £51m of pay, so far. [click the image for an enlarged view]

Cliff Weight, Director, ShareSoc

A copy of the Minerva (Manifest) report is available free to ShareSoc Full members via the Remuneration Forum, https://sharesoc.ning.com/forum/topics/remuneration-forum?commentId=6389471%3AComment%3A53122