ShareSoc

INVESTOR ACADEMY

Advanced Topics

Once you understand the basics of stock market investment, and start investing, you will encounter a number of more in-depth issues that you ought to understand to invest as successfully as possibly and avoid pitfalls. ShareSoc offers a comprehensive series of its own articles that help to explain some of the deeper “mysteries”, which are catalogued below.

Indicates that the information referenced is provided exclusively to full members of ShareSoc. To access that content, sign up here. Once you have joined, you will receive full member login instructions, which will enable you to access our premium content, including our extensive library of AGM and remuneration reports, and the advanced topics described. If you are a full member of ShareSoc and are having any difficulty logging in, please contact our office.

the information referenced is provided exclusively to full members of ShareSoc. To access that content, sign up here. Once you have joined, you will receive full member login instructions, which will enable you to access our premium content, including our extensive library of AGM and remuneration reports, and the advanced topics described. If you are a full member of ShareSoc and are having any difficulty logging in, please contact our office.

Understanding nominee accounts

Most investors’ shares are held in “nominee accounts”. Do you understand what this means for your rights and ownership? Once you understand the impact on your rights of the present nominee ownership system, support our shareholder rights campaign!

Personal CREST accounts

what they are and the benefits of using them, including a directory of brokers offering personal CREST accounts.

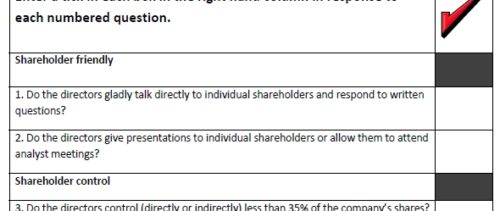

AIM Company Scorecard

AIM Company Scorecard

A useful systematic tool developed by ShareSoc for evaluating potential AIM quoted investments.

Tax advantaged investments

Tax advantaged investments

Depending on your personal tax situation, these investments (such as VCTs and EIS qualifying investments) may offer particular advantages to you.

How to Run a Company Campaign

ShareSoc campaigns on both specific company issues and on individual shareholders’ wider concerns. We have been successful in obtaining change at a number of companies since we were founded and have influenced government policy and legislation. If you are considering forming a “shareholder action group” to tackle a specific company, you should read this note first: Shareholder Action Groups (a pdf document).